Introduction

NVDA Stock Split Corporation (NVDA) stands as a global leader in technology, renowned for its groundbreaking innovations in graphics processing units (GPUs) and artificial intelligence. As one of the most influential companies in the semiconductor industry, NVDA Stock Split attracts considerable interest from both retail and institutional investors. Among the various market events that spark excitement, NVDA Stock Split splits have always been highly anticipated.

A NVDA Stock Split is a corporate action that increases the number of shares outstanding by issuing additional shares to existing shareholders. This results in a proportional decrease in the stock’s price per share, making it more accessible to investors. For companies like NVDA Stock Split, stock splits enhance liquidity and signal confidence in their growth trajectory. This article explores everything investors need to know about NVDA stock splits, their history, and their significance in the investment world.

What is a Stock Split?

A NVDA Stock Split occurs when a company divides its existing shares into multiple shares. For instance, in a 2-for-1 split, each shareholder receives an additional share for every share they own, effectively doubling the total shares while halving the price per share. This corporate action does not affect the company’s overall market capitalization; instead, it redistributes the equity into smaller, more affordable units.

The reasons behind NVDA Stock Split are often tied to its commitment to maintaining affordability and encouraging broader participation in its growth story. As NVDA Stock Split continues to expand its influence across industries like AI, data centers, and autonomous vehicles, stock splits serve as a strategic tool to sustain investor interest.

The Most Recent NVIDIA Stock Split

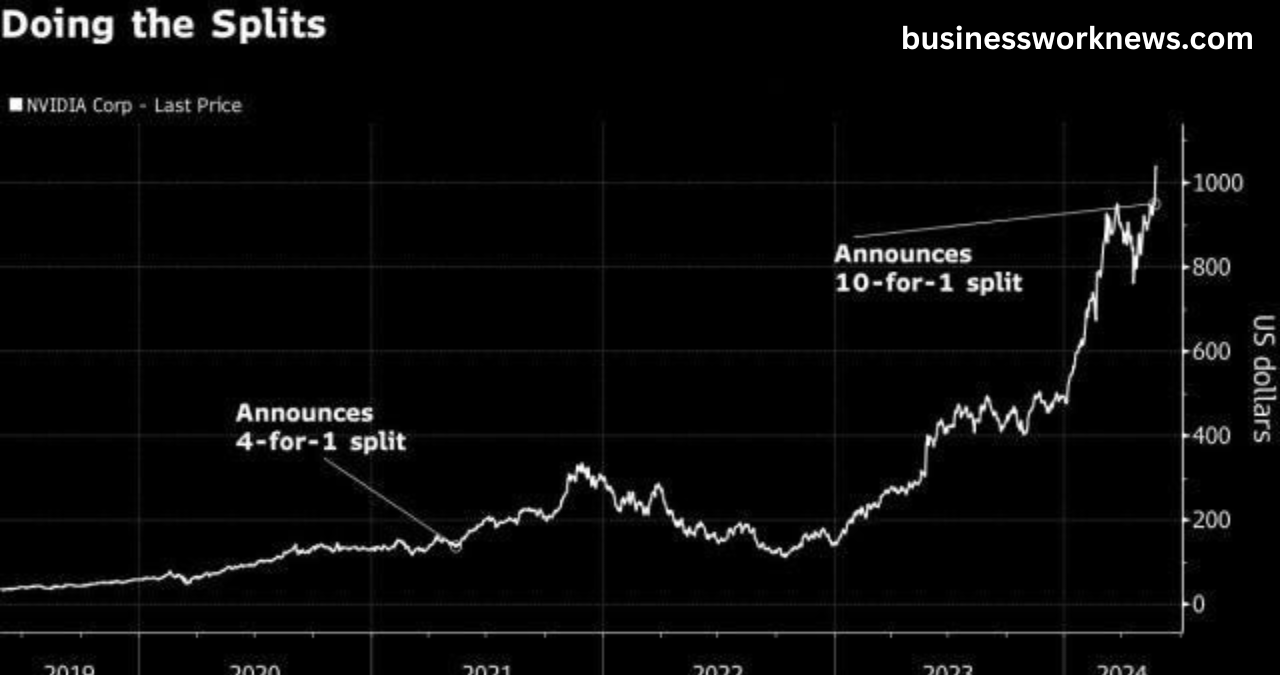

NVDA Stock Split most recent stock split, a 4-for-1 split, took place on July 20, 2021. Under this split, shareholders received three additional shares for every share they owned, effectively quadrupling the total number of shares outstanding. The share price adjusted proportionally, dropping from approximately $750 to $187.50 post-split.

The decision to split came amidst NVDA Stock Split rapid ascent in the semiconductor market. With its shares reaching record highs, the split aimed to make the stock more affordable to individual investors while enhancing liquidity. The announcement was met with enthusiasm, and NVDA Stock Split price climbed in anticipation of the split.

Post-split, NVDA Stock Split continued its upward trajectory, driven by strong earnings reports and robust demand for cutting-edge technologies. Analysts lauded the move as a testament to NVIDIA’s confidence in its long-term growth. The 2021 split exemplifies how strategic timing and market sentiment can amplify the benefits of such corporate actions.

Why Stock Splits Matter to Investors

Stock splits appeal significantly to investors, especially those eyeing high-growth companies like NVIDIA. Here are some key reasons why stock splits matter:

Accessibility for Retail Investors

A stock split lowers the price per share, making it more accessible to small-scale investors. This increased affordability often leads to broader market participation, enhancing the company’s shareholder base.

Psychological Impact

Stock splits create a perception of value and growth. A lower share price often appears more attainable, encouraging investors to buy. This psychological effect can drive demand, pushing the stock price higher in the short term.

Enhanced Liquidity

Stock splits improve liquidity by increasing the number of shares in circulation. Higher trading volumes make it easier for investors to buy and sell shares without significantly affecting the stock’s price.

Growth Confidence

A stock split signals the company’s confidence in its future performance. For NVIDIA, each split has underscored its position as a market leader poised for sustained growth.

How to Evaluate NVIDIA Post-Split

Evaluating NVIDIA post-split requires a focus on key financial and operational metrics. While the split itself does not alter the company’s fundamentals, it’s essential to consider factors such as:

- Earnings Performance: Monitor NVIDIA’s quarterly earnings to assess revenue growth, profitability, and market share expansion.

- Industry Trends: Stay informed about trends in AI, gaming, and cloud computing, which drive NVIDIA’s core business.

- Valuation Metrics: Analyze price-to-earnings (P/E) ratios and other valuation indicators to determine if the stock remains a good investment post-split.

- Market Sentiment: Observe trading patterns and institutional investor activity, as these can signal confidence in the stock’s trajectory.

Comparing NVIDIA to peers like AMD and Intel can also provide insights into its competitive positioning. For long-term investors, NVIDIA’s strategic initiatives and innovation pipeline remain critical considerations.

Conclusion

NVIDIA’s stock splits reflect the company’s commitment to fostering inclusivity and accessibility for investors. These splits attract a diverse investor base by making shares more affordable while maintaining confidence in the company’s long-term prospects. From its history of splits to the most recent 4-for-1 split in 2021, NVIDIA’s actions highlight its strategic approach to growth.

Understanding the implications of stock splits is crucial to making informed investor decisions. While splits do not inherently increase the value of an investment, they can boost liquidity, market participation, and investor sentiment. NVIDIA’s trajectory post-split reaffirms its status as a tech powerhouse poised for continued success.

Frequently Asked Questions (FAQs)

Q: What is a stock split, and why do companies like NVIDIA do it?

A: A stock split increases the number of shares while reducing the price per share. Companies like NVIDIA use splits to make their stock more affordable and enhance market liquidity.

Q: How many times has NVIDIA split its stock?

A: NVIDIA has executed four stock splits: in 2000, 2001, 2006, and 2021.

Q: Does a stock split increase the value of my investment?

A: No, a stock split does not change the overall value of your investment. It only increases the number of shares while reducing the price per share proportionally.

Q: Is NVIDIA a good investment after the most recent stock split?

A: NVIDIA remains a strong contender in the tech industry. However, investors should evaluate its fundamentals, market trends, and valuation before making a purchase.

Q: How does NVIDIA’s stock split compare to other tech giants like Apple or Tesla?

A: Like Apple and Tesla, NVIDIA’s stock splits aim to make shares more accessible while signaling growth confidence. Each company’s split strategy aligns with its unique market position and goals.

You May Also Read: https://businessworknews.com/hmny-stock/